Protect Yourself From Tax Scams

With the increasing complexity of tax law and the massive amount of paperwork involved in tracking and filing taxes, it has become easier than ever for certain unscrupulous individuals to cheat honest taxpayers and businesses out of their hard-earned money. While scammers get more creative day by day, there are a few simple guidelines that you can follow in order to protect yourself.

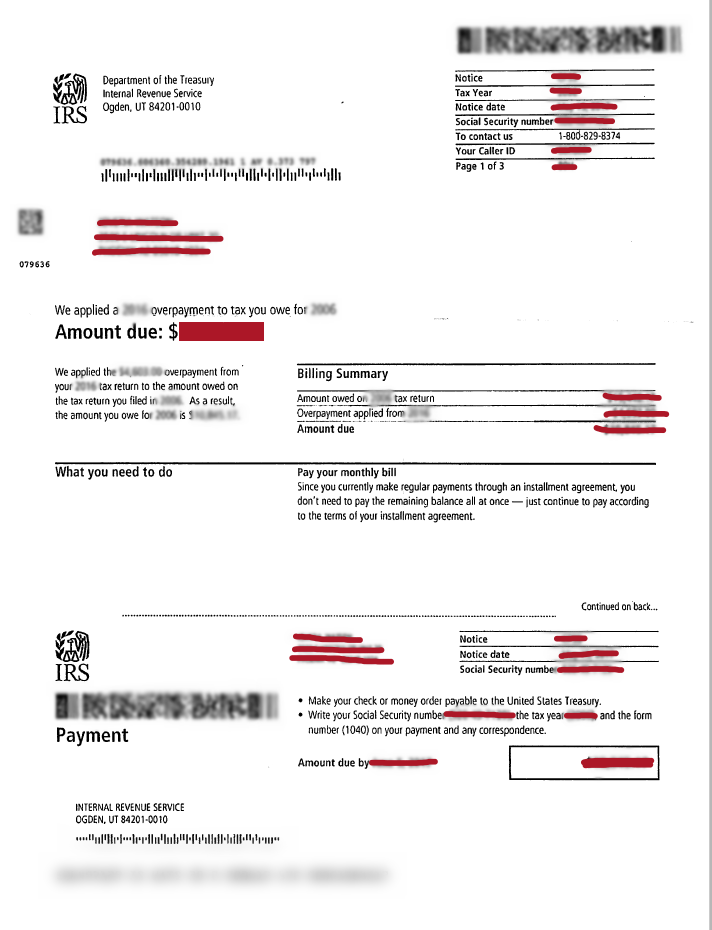

About IRS Notices

If the IRS has determined a deficiency or there is any other issue with your return, you will be issued a letter with a notice number with the option to either pay the amount due if you agree with the assessment or appeal your case if you disagree. Notices from your state or local revenue collection agencies may look different, but usually provide similar guidelines.

The tone of the letter is professional and cordial, never threatening or excessively urgent. The IRS knows that their protocol is subject to error and you will always have the chance to appeal a new issue. You can also call the IRS help line at the number provided below and give the notice number to verify the legitimacy of the letter.

Business: 800-829-4933

Estate and Gift: 866-699-4083

Exempt Organizations: 877-829-5500

Accessibility: 800-829-4059

The IRS only initiates contact with taxpayers by telephone in rare circumstances. Even then, phone calls are usually preceded by written notices sent through USPS Mail. The IRS will never contact taxpayers through email, text message, social media, or third party chat programs.

An IRS Agent will never threaten the interference of law enforcement or immigration officials, as the IRS has very little influence over these other government agencies and must go through the proper legal channels to access them. An IRS Agent does not have police powers and is not able to arrest, imprison, or deport taxpayers, revoke driver’s licenses or state IDs, or withhold business licenses upon condition of payment.

On the phone, IRS Agents are required to be calm and polite and should not become hostile. They will never ask for credit card numbers over the phone, threaten penalties, or swear. The appeals process, audit, and the court process all take time. In some cases, there can be years between the original determination and the final collection of payment, due to a lengthy trial and other associated legal processes. There is no reason that you must pay immediately.

Checks or money orders for the payment of taxes must always be made out to “United States Treasury”. The IRS will never require payments to be made in any particular format and will never ask for prepaid debit cards, physical cash, or third party merchandise cards.

Always be suspicious of unexpected tax bills. If you do get an IRS notice, there is no need to panic. Review the issue carefully and send back a written response. If you need assistance, or would rather leave dealing with tax notices to the professionals, please give us a call at (303) 753-8905. We at TRKM would be happy to handle it on your behalf.

Common Tax Scams

In contrast to real IRS representatives, who are interested in determining and collecting exactly the correct amount of tax, scammers are interested in either collecting a payment or collecting taxpayer information for the purpose of committing identity fraud.

By phone, scammers may attempt to intimidate taxpayers into giving credit card numbers or submitting another form of payment for a fictional new tax such as the recent “student tax”. They may also take the opposite approach by asking taxpayers to give personal information to confirm their identities to collect a potential refund. Through web based media such as email and third party chat, scammers will attempt to trick taxpayers into clicking on links that download malware, or giving out personal information.

Report Scamming

The official IRS website is IRS.gov. Scammers may use similar domain names such as InternalRevenueSociety.net, IRS.net, IRSGov.com. The format of state domains vary, but only official government and state agencies are able to use the “.gov” address and will never appear as “.net”, “.org” or “.com”. If you find a suspicious domain, you can report it to phishing@irs.gov with the subject line “Suspicious Website”

If you receive a suspicious email, do not reply, open attachments, or click on any links. Instead, forward the email to phishing@irs.gov, then delete the original email. Be sure to forward the original email, not screenshots or photos.

If you receive a suspicious phone call, do not give any personal information. Ask for the caller’s name if you can and report the incident using the TIGTA Form or to phishing@irs.gov with the subject line “IRS Phone Scam”.

If you receive a suspicious letter, notice, or fax, do not respond. Instead, report the incident using the TIGTA Form or to phishing@irs.gov.

Additional Resources

How to Know It’s Really the IRS

How to Report Phishing

Taxpayer Bill of Rights